Travel insurance can be polarizing, but this guide isn’t about whether it’s worth it — it’s about comparing the top providers to help you find the best option for your next trip.

In this guide, we’ll review policies from seven top travel insurance providers so you can better understand your options before choosing a specific policy and provider.

Should you get travel insurance if you have credit card protection?

travel rewards cards.

Why consider Allianz Travel Insurance?

- Some single-trip plans allow you to purchase an upgrade that lets you cancel your trip for any reason and get 80% of your nonrefundable trip costs back.

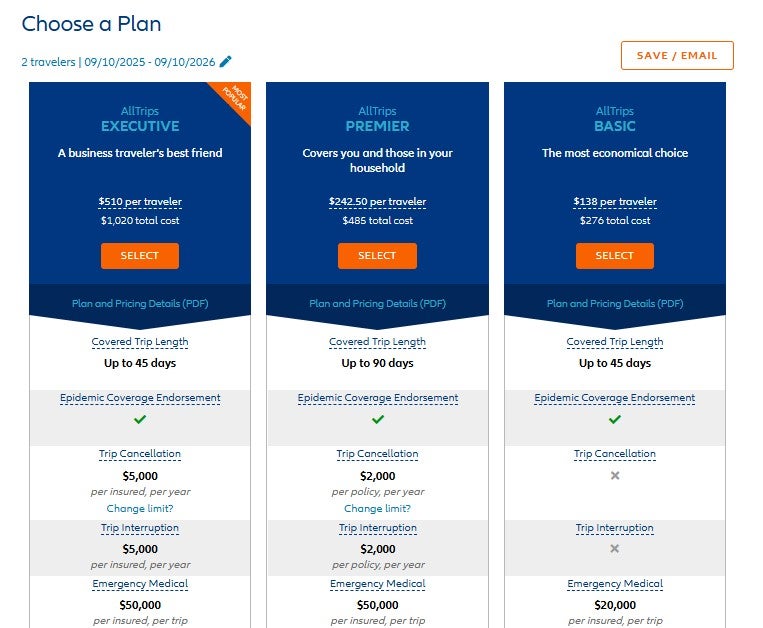

- The AllTrips Premier plan provides annual coverage on trips of up to 90 days for all your household members at a fixed rate, even when household members are traveling separately.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance

American Express cardholder to purchase this insurance.

Amex’s build-your-own-coverage plan is unique because you can purchase just the needed coverage. For most types of protection, you can even select the coverage amount that works best for you.

Why consider American Express Travel Insurance?

- Amex’s build-your-own-coverage option allows you to only pay for the coverage you need.

- Coverage on long trips doesn’t cost more than coverage for short trips if the cost is equal. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other points and miles aren’t covered.

Purchase your policy here: American Express Travel Insurance

GeoBlue

IMG

buy an annual travel insurance plan through Travel Guard that covers multiple trips of up to 90 days. And if you book a last-minute trip, Travel Guard’s single-trip policy without trip cancellation protection might be worth considering.

Why consider Travel Guard?

- On most single-trip plans, you can include one related child (age 17 and younger) with each paying adult at no additional cost.

- Some single-trip plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% of your covered trip cost.

- You can add optional bundles to single-trip plans, including adventure sports, baggage, travel inconvenience, quarantine, pets, security and wedding travel.

Purchase your policy here: Travel Guard

Travelex Insurance

World Nomads

InsureMyTrip or SquareMouth to search. Just note that these search engines won’t show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA and Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Valuable travel perks that you can get with a credit card

credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won’t cover you at your destination and you can’t comfortably cover a sizable medical evacuation bill or last-minute flight home. In that case, it may be worth purchasing travel insurance. Buying an annual multitrip policy may be worth it if you travel frequently.

Related: 7 times your credit card’s travel insurance might not cover you

Baggage delay protection may reimburse you for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. You may be reimbursed up to a particular amount per incident or day.

Related: Comparing travel protections with the Chase Sapphire Reserve and Amex Platinum

My 4 top travel credit cards — and how they elevate my trips

The best no-foreign-transaction-fee credit cards

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. This will help you choose a plan appropriate for you and your trip.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn’t exclude these activities. Likewise, if you’re making two back-to-back trips during which you’ll be returning home for a short time in between, be sure the plan doesn’t terminate coverage at the end of your first trip.

Finally, if you’re looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won’t help if your policy doesn’t cover your losses.